"Super" Catch-Up Contributions for 2025

"Super" Catch-Up Contributions for 2025

If you’re in your sixties and looking to enhance your retirement strategy, the SECURE Act 2.0 has introduced a unique opportunity for individuals aged 60-63 who can now take advantage of a $11,250 “super” catch-up contribution.

Following the revised age for Required Minimum Distributions (RMDs) and expanded access to 401(k) plans for part-time employees under SECURE 2.0, this new tiered system applies to workers participating in 401(k), 403(b), governmental 457 plans, and the federal government’s Thrift Savings Plan. With higher contribution limits, eligible individuals can contribute more to their retirement savings and potentially reduce their taxable income.

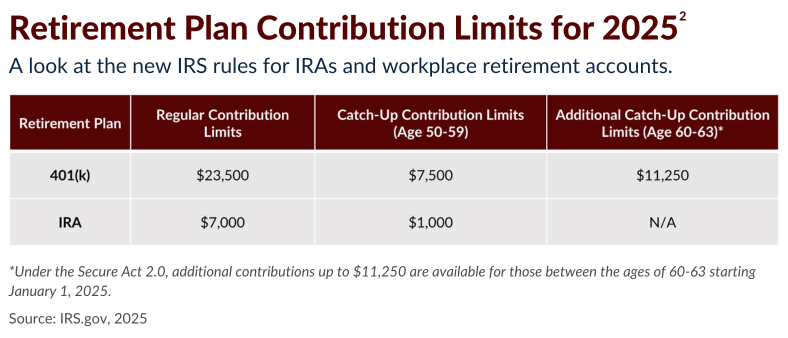

The base annual contribution limit for these accounts has increased from $23,000 to $23,500 in 2025. The contribution limit for regular Individual Retirement Accounts (IRAs) remains at $7,000, with an additional $1,000 catch-up contribution available for those over 50.1

For workplace retirement accounts such as 401(k)s, the traditional catch-up contribution for individuals over 50 also remains the same at $7,500 for 2025. However, this new “super” catch-up contribution supersedes the 50+ catch-up during the eligible 60-63 age window. Although these two options cannot be utilized simultaneously, they can still make a meaningful impact on your retirement and tax strategies if you qualify. The chart below provides a detailed breakdown of contribution limits for 2025.1

For clients who participate in workplace plans, this offers an opportunity to reevaluate their contributions and potentially invest more money into their retirement strategy. If you are eligible or think this could benefit your current retirement strategy, feel free to reach out and let’s discuss how we can help you make it happen.

1IRS, November 12, 2024

2Once you reach age 73, you must begin taking required minimum distributions (RMDs) from your 401(k) or other defined contribution plan, as well as traditional IRAs, in most circumstances. Withdrawals from a traditional IRA, 401(k), or other defined contribution plan are taxed as ordinary income and, if taken before age 59 1/2, may be subject to a 10% federal income tax penalty.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.