5 Smart Investing Principles

5 Smart Investing Principles

There is no shortage of self-help material available for people looking to boost their investing knowledge. Between television programs, magazines, and other information sources, you can read about “The Best” this and “The Most Important” that. It can be easy to get confused, especially when you get conflicting ideas.

Understanding a few key investment principles can be a great place to start. It can give you a better framework to understand the information as you take in the ideas. It can also provide context for evaluating the concepts and strategies suggested.

We’ll go through five smart investing principles that could help you understand what it takes to create an investment portfolio that’s designed to pursue your investment goals.

1. Estimate Your Time Horizon.

Is your investment horizon three years away or 30 years? Generally, if your time horizon is short, you may be more comfortable with a more conservative investing approach. Certain investments can be volatile and may not be appropriate if you have a short-term horizon.

If your child is headed to college in five years, many people would say you have a mid-term horizon. You may want to be less conservative with your investing approach and have a larger exposure to equity investments.

When you have a long-term horizon, you may consider adopting a more aggressive approach. If you intend to retire in 10–15 years, having a larger exposure to stock investments may make more sense. One way to lower your exposure to stock market risk is by investing for the long term, which gives your money time to recover from periods of market fluctuations and loss.

2. Know Your Risk Profile.

Can you tolerate big swings in the value of your investments, or do you prefer less volatility? Knowing your risk profile is an important step as you consider various types of investments.

It’s easy to say, “I can handle a high level of risk,” but that may or may not be the case. It’s a good idea to ask yourself some pointed questions and be honest with the answers. What happens to my outlook if the value of my investment drops? How much could I lose and stay in the market?

It’s also helpful to ask yourself, “How would I describe my investment knowledge?” There are some television programs that help people understand investments and how markets work. But if most of your investment knowledge has come from television personalities, you may want to consider getting a second opinion on your approach.

What would you rather have, $500 right now or a 50% chance at $2,000? Many people go for the $2,000, and rightfully so. Since you have a 50/50 chance, a decision tree shows the $2,000 answer carries a potential value of $1,000.

But let’s add a few zeros and see if that changes your perspective. What would you rather have, $50,000 right now or a 50% chance at $200,000? The decision tree says the opportunity to win $200,000 has the highest potential value. But in reality, many people second-guess that decision because $50,000 is a lot of money.

Remember, there is no correct answer to these questions. They will help you better understand the concept of risk.

3. Diversify, Diversify, Diversify.

Diversification suggests that a portfolio of different kinds of investments, on average, may potentially yield a higher return and pose less risk than any individual investment.

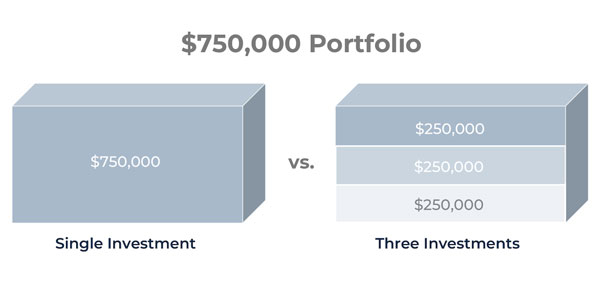

Let’s assume we have an investor who has $750,000 to invest. On the left is a hypothetical example of $750,000 placed into a single investment.

On the right is a hypothetical example of the same amount divided between three investments.

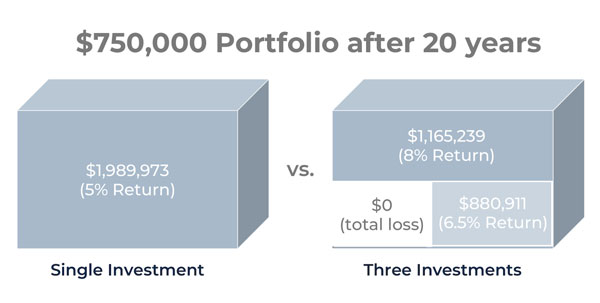

After 20 years, the single investment, assuming a 5% annual return, will have grown to roughly $2 million.

During the same period, our diversified portfolio will have grown to just over $2 million. And in this example, we’re assuming that one of the investments was a total loss; that is, it was worth nothing at the end of 20 years.

4. Consider the Effects of Taxes and Inflation.

Americans pay income taxes, Social Security taxes, sales and excise taxes, and property taxes. The same concept occurs when you put your money to work. Taxes may take part of your return. So when you are looking at the return on an investment, ask yourself, “What is my return after taxes?”

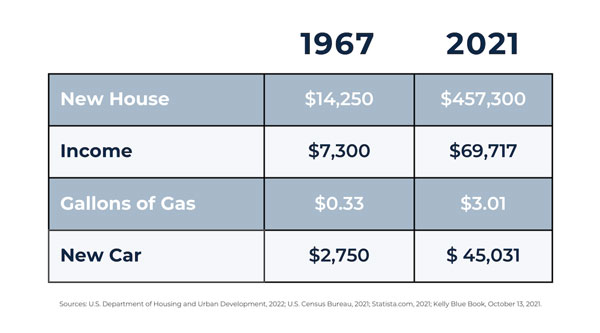

Another silent thief you have to watch out for is the effect of rising prices, otherwise known as inflation. Over the long term, inflation erodes the purchasing power of your income and wealth, just look at prices from 1967.

In 1967, a new house cost $14,250. Income was $7,300 per year. A gallon of gas cost 33 cents. And the average cost of a new car was $2,750.

In 2017, the average price of a new home was $402,900. The median household income was $61,372 per year. The average price for a gallon of gas was $2.42, and the average price of a new car was $36,113.

5. Get Started Now.

Take the initiative and get going. If you learn nothing else today, please understand the importance of getting started now. When it comes to pursuing in investment goals, the more time you have the better. Procrastination can be costly.

For example, if you were to deposit $250,000 in an account earning 6%, at the end of 20 years your account would be worth $801,784.

If you waited five years before starting your investment program, the $250,000 would have 15 years to work and would grow to $599,140. And if you waited 10 years, you’d only end up with $447,712. Put simply, waiting 10 years to start was a $350,000 decision.

When you’re ready to move forward, here are some specific action items to help you get started:

- Put together a personal income statement. You want to identify all your sources of income and where your money is going.

- Put together a simple balance sheet. This should give you a good snapshot of your assets and liabilities.

- Identify your long-term, medium-term, and short-term financial goals.

- Be honest with yourself about your tolerance for risk. Can you stomach big market swings or are you more comfortable with less volatility?

Our team specializes in helping people just like you set up investment strategies that help them pursue their investment objectives. There are a number of strategies you can use to attempt to invest wisely, so reach out to discuss your situation with a financial professional.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.