Is TINA the Right Money Manager for Your Retirement?

Is TINA the Right Money Manager for Your Retirement?

You might be asking yourself, “Who is TINA? And why would they be managing my money?” TINA is an acronym that stands for “There is No Alternative” to stocks. For most retirement-minded investors, “TINA” could be considered their money manager.

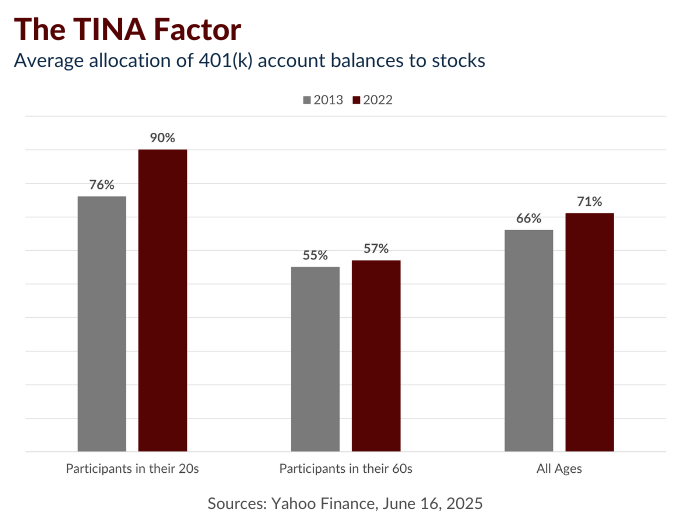

As the chart below indicates, 71% of 401(k) account balances were allocated to stocks in 2022. People in their 60s had slightly less allocated to stocks, while participants in their 20s were almost exclusively in equities.1

It’s difficult to argue against the strategy, especially for someone in their 20s. Since 1957, the Standard & Poor’s 500 index has delivered an annual return of more than 10%. But patience, focus, and commitment are required. The path since 1957 has been anything but smooth, with recessions, global crises, and geopolitical events all taking place along the way.2,3

Thus, the question remains: for people who are approaching retirement, should TINA be managing their money?

It’s possible, but there are many other factors to consider when a person stops accumulating assets and starts spending those assets that they have spent a lifetime accumulating. Not to mention accounting for how Social Security factors into the equation.4

When we create a financial strategy for our clients, we allocate assets based on their personal goals, risk tolerance, and timeline. So, TINA will likely be part of those conversations, but is certainly not the only voice in the room.

If you have questions about TINA’s role in your overall financial strategy or would like to revisit your retirement plan, please feel free to reach out.

1Yahoo Finance, “The Stock Market’s Secret Weapon: Insatiable Demand from American Retirement Accounts.” June 16, 2025.

2Investopedia.com, “S&P 500 Average Returns and Historical Performance.” May 16, 2025.

3The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

4Once you reach age 73, you must begin taking required minimum distributions (RMDs) from your 401(k) or any other defined contribution plan in most circumstances. Withdrawals from your 401(k) or any other defined contribution plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.