Is the Bear Market Over?

Is the Bear Market Over?

“Is the bear market over?”

That’s a question I’ve been asked a number of times in recent weeks. And my answer is the same, “Let’s give it a little time.”

But people are quick to remind me that stocks are off to a good start in 2023, inflation appears to be trending lower, and the economy was strong in Q4. All true. But it takes more than a few good weeks and a couple of solid economic reports to inspire a new market cycle.

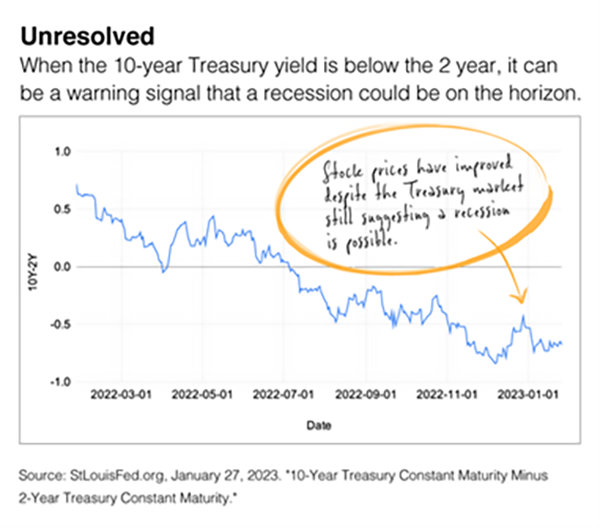

Right now, there are several questions that the financial markets need to address in the coming months. For example, will the economy enter a prolonged slowdown? The accompanying chart shows the US Treasury market is still signaling a recession.

What I can tell you is that between 1942 and 2021, the average Bull market lasted 52.8 months, while the average Bear market lasted 11.3 months. The Bear market of 2020 ended in a little over one month, but the back-to-back bear markets of the early 2000s spanned a painful 2½ years.1

The current Standard & Poor’s 500 bear market was called on June 13, 2022, when stock prices dropped 20% from their high. Some people point out that stock prices started trending lower in January 2022, but that wasn’t the beginning of the bear market.2,3

As we get deeper into 2023, the team of professionals that I work with will continue to review economic data and company reports to get a better understanding of what trends are emerging. We’ll gather and evaluate that information and relay to you any updates that may affect your financial situation.

1CaptiveInternational.com, September 9, 2021. “Playing the odds: Bull vs Bear markets.”

2Forbes.com, November 23, 2022. “When Will the Bear Market End?”

3The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.