Capitalizing on U.S. Innovation in the Age of AI

Capitalizing on U.S. Innovation in the Age of AI

As a financial advisor, I closely monitoring economic trends as they evolve. Over the past year, I’ve witnessed the remarkable advancement of artificial intelligence (AI) and its impact on the investment landscape. This rapid progression and fast-paced decision-making within the U.S. tech industry have put a spotlight on an era of innovation that presents unique investment opportunities.

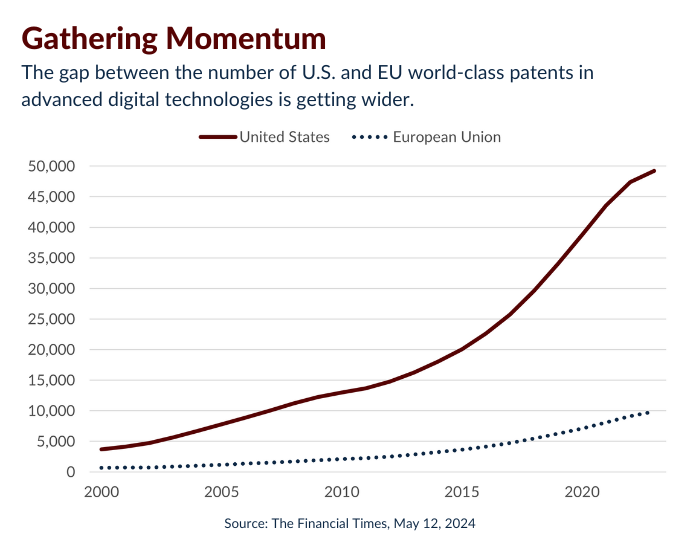

At the same time, these trends cast some concerns that Europe and other parts of the world are lagging in AI innovation and adoption. The chart below illustrates how quickly U.S. companies have reacted to major tech advancement events over the last 20 years when it comes to securing patents for digital technologies compared to their European counterparts.

What’s next, particularly for this transatlantic divergence? As European economies grapple with their own challenges, it’s important to keep a close eye on monetary policy changes, such as potential rate adjustments by the European Central Bank or the Bank of England, which could influence global market dynamics. The Federal Reserve, on the other hand, may need some flexibility.

Remember, about 40% of S&P 500 company revenues are generated outside of the United States, so the vitality of European and other global economies will be crucial to monitor moving forward. Broad support will certainly be needed to help boost the “E” part of the price-to-earnings (P/E) ratio.

If you have questions about current economic trends and how they could impact your personal financial plan, please feel free to reach out.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.