Fed Changes Its Outlook as Inflation Drops

Fed Changes Its Outlook as Inflation Drops

Baseball legend Yogi Berra famously said, “It ain’t over ‘til it’s over.” Fed Chairman Jerome Powell appears to have taken those words to heart in recent months.

Following the Fed’s June meeting, he said that “Inflation has eased over the past year but remains elevated.” In other words, “it ain’t over ‘til it’s over.” The Fed wants to see some more progress toward their 2% target inflation goal before considering any monetary policy changes.

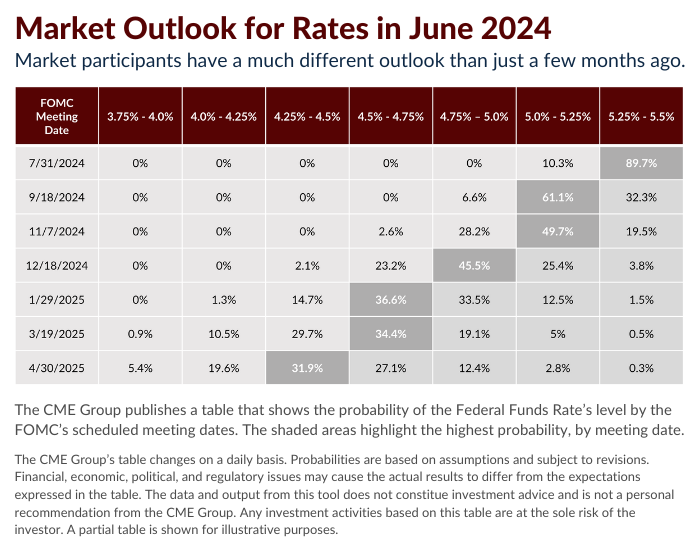

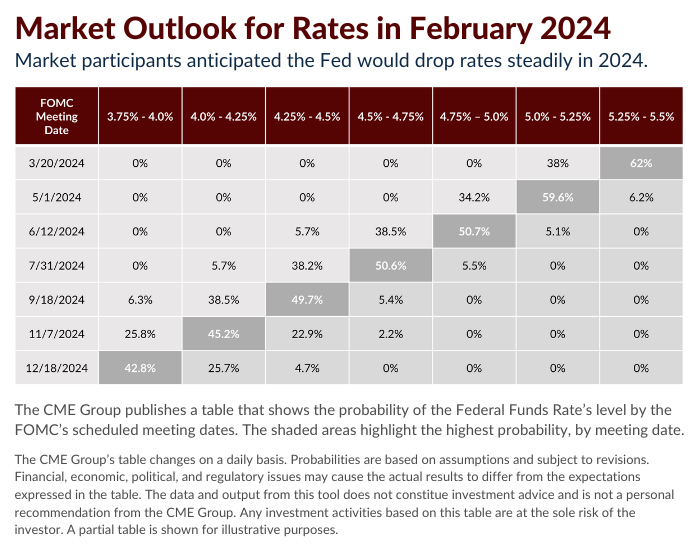

You may recall that just a few months ago, the Fed seemed prepared to cut rates as many as three times in 2024. However, an uptick in inflation in Q1 forced them to revise their outlook and most Fed officials now anticipate cutting short-term interest rates just once this year.

The Fed’s about-face serves as a good lesson for all investors. Changes in your personal goals, time horizon, and risk tolerance should be what influence adjustments to your portfolio, not forecasted projections. The economy is everchanging and markets shift on a daily basis. The Federal Reserve will adjust its strategy in response to what’s happening.

When I advise my clients to “stay the course” and not overreact to headlines, it’s because I’ve experienced several economic cycles that have taken longer than originally expected to resolve. I’ve also seen other cycles conclude earlier than expected. So today, I ask myself, “Is the Fed going to stick to its one-cut strategy or update its approach at the next meeting?” Recent history would suggest it’s about a 50/50 chance!

At Concord, our strategy isn’t dependent on what the Fed does or doesn’t do, so let’s stay the course and remember, “It ain’t over ‘til it’s over.”

If have questions about the state of the economy or would like to revisit your financial plan, please don’t hesitate to reach out.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.