Fed Frustration: Navigating Times of Uncertainty

Fed Frustration: Navigating Times of Uncertainty

Keeping up with the Federal Reserve lately feels like watching a never-ending tennis match. The constant back-and-forth has caused a mix of anxiety, anticipation, and confusion for investors.

At its March meeting, Fed officials projected three quarter-point reductions in short-term interest rates by the end of 2024. However, that narrative quickly changed as the situation became more complex.1

In the weeks that followed, Atlanta Fed President Raphael Bostic projected one cut, San Francisco’s Mary Daly noted that there are no guarantees, and Cleveland’s Loretta Mester said rate cuts may not come until later this year. Minneapolis Fed President Neel Kashkari hinted at no cuts still being a possibility while Fed Governor Michelle Bowman suggested that rates may have to move higher in order to control inflation.2

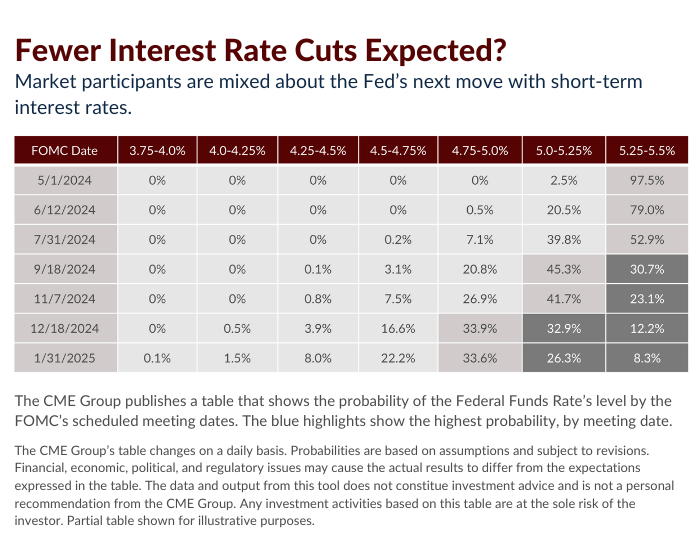

Feeling confused? You’re not alone—so are the financial markets. Market speculators are now leaning towards only one or two cuts this year, but as the percentages below indicate, there’s a lack of strong conviction behind any of the outlooks.

The April Consumer Price Index report only added to this ambiguity. Since consumer prices came in a bit hotter-than-expected, investors have been left wondering what the Fed will do next.3

During times of uncertainty, it is crucial to tune out the noise and remain focused on your personal investment strategy. If you need some guidance or reassurance, please don’t hesitate to reach out.

1CNBC.com, March 20, 2024. “Fed holds rates steady and maintains three cuts coming sometime this year.”

2CNBC.com, April 5, 2024. “Fed’s Powell emphasizes need for more evidence that inflation is easing before cutting rates.”

3Reuters.com, April 10, 2024. “US consumer prices heat up in March; see delaying Fed rate cut.”

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investment advisory services are offered through Concord Wealth Partners, an SEC Registered Investment Advisor.