How Financial Markets Impact Household Spending and Debt

How Financial Markets Impact Household Spending and Debt

The popular expression, “A rising tide lifts all boats,” aptly applies to financial markets as well. A market rally not only creates wealth but can also play a significant role in debt management.

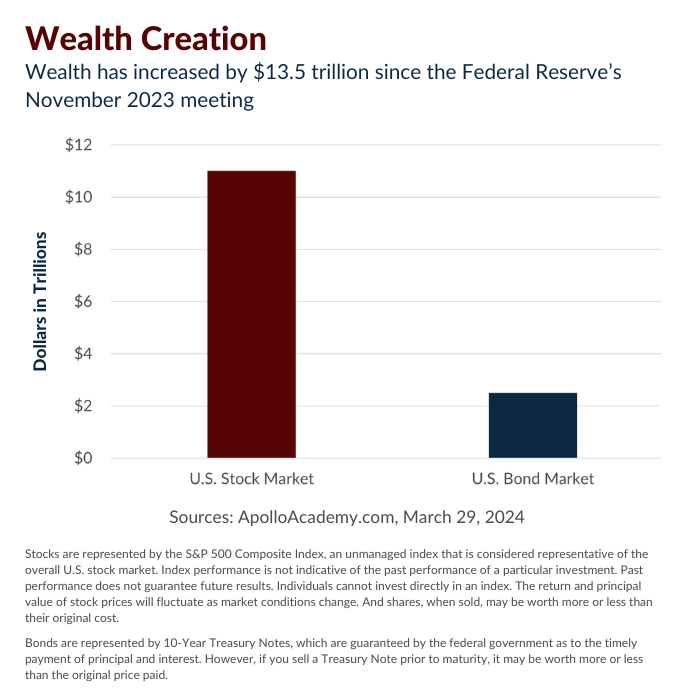

As you can see in the chart below, total U.S. household wealth has increased by $13.5 trillion since the Fed announced it was pivoting to a more accommodating monetary policy following its November 2023 meeting. The stock market has led the way, but the bond market isn’t too far behind, reflecting the potential for increased financial stability and spending power among consumers.1

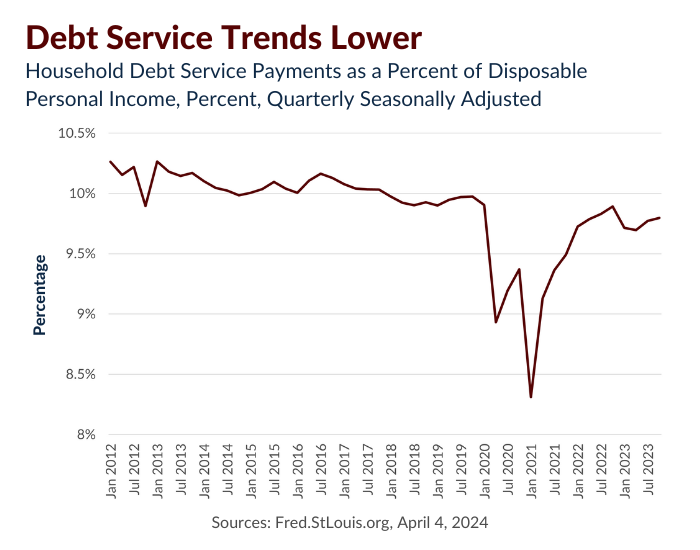

Moreover, the latest figures reveal a downward trend in household debt service payments as a percentage of disposable income. This trend prompts the question: how much of this newfound wealth will be redirected toward managing household debt?2

Keep in mind that consumer spending contributes roughly 70 percent of the country’s gross domestic product. The dual advantages of wealth creation and the improving debt position suggest a promising outlook for consumer financial health in the months ahead.

In light of these trends, remember that any concerns regarding the financial health of U.S. households should be tempered with the understanding that household balance sheets are in a better position than they have been in some time.

If you have questions about your household spending, debt situation, or the broader economic environment, please do not hesitate to reach out.

1ApolloAcadeny.com, March 29, 2024

2Fred.StLouisFed.org, April 4, 202

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.