The Fed's Quest for 2% Inflation

The Fed's Quest for 2% Inflation

As Wall Street continues to ponder when the Fed will start cutting interest rates, perhaps the better question is, “What is the Fed looking for before it would consider cutting interest rates?”

Fed officials indicated in December that as many as three rate cuts were possible this year, but Chairman Powell said this month that there was no hurry to change its interest rate policy. In fact, he remarked that the Fed is not looking for better data, but more good data pointing to cooling inflation.

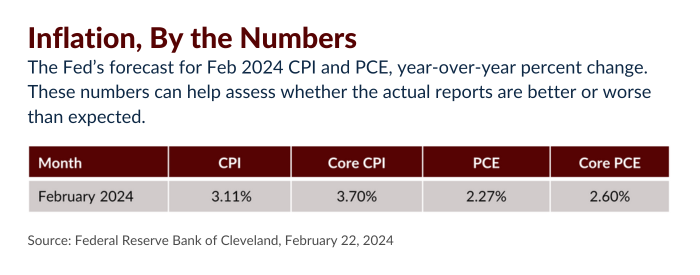

Remember that January’s inflation report was a bit hotter than expected, which complicated the Fed’s interest rate decision. It also puts a spotlight on the February Consumer Price Index (CPI) update and the Personal Consumption Expenditures Price Index (PCE), which is the Fed’s preferred inflation index. Will the numbers support the “more good data” narrative or further complicate things for the Fed?

The next scheduled Federal Open Market Committee (FOMC) meeting concludes on March 20. After that, it has six more scheduled meetings in 2024. It’s important to note though that the Fed can also hold unscheduled meetings as needed, the last of which was in March 2020 in response to the COVID-19 pandemic.

According to the CMEGroup’s FedWatch Tool, almost no market watchers are anticipating a rate cut at the March meeting and support for one at the May meeting is fading. Speculators remain mixed about a possible cut in June and July. Despite the election looming, the Fed takes its independence very seriously, so it is unlikely that the election cycle will impact if and when interest rates are lowered.1

So, will the Fed cut rates in 2024? The trends appear to be moving in that direction, but it’s uncertain when the Fed will finally feel comfortable.

If you have questions or concerns about the state of the economy or your personal financial situation, please don’t hesitate to reach out.

1CMEGroup.com, February 22, 2024. “CME FedWatch Tool.”

Related Topics

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investment advisory services are offered through Concord Wealth Partners, an SEC Registered Investment Advisor.