The Fed Signals Rate Cuts in 2024

The Fed Signals Rate Cuts in 2024

Fed Chair Powell finally made his much-anticipated “pivot” at the close of the Fed’s two-day December meeting earlier this month, saying he sees short-term rates heading lower next year. Perhaps much lower.

Surprised but excited, the financial markets rallied on the Fed’s policy pivot. But market watchers know the hard part comes next—how to position portfolios in a falling rate environment.

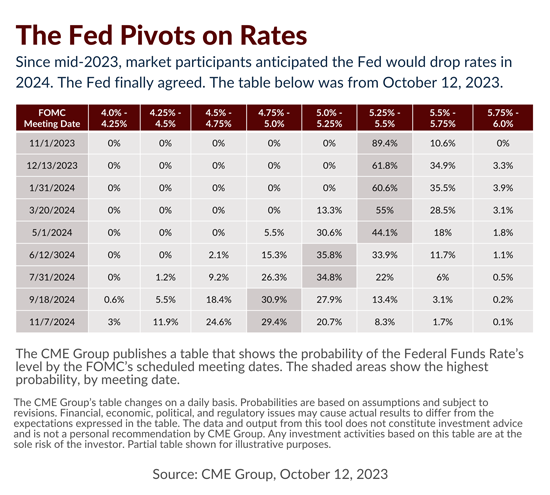

For much of 2023, the financial markets had anticipated the Fed would drop rates in 2024. The table below was from October 2023, when market watchers anticipated two rate cuts in 2024. But two weeks later, at its November meeting, Powell said the Fed had no interest in cutting rates anytime soon.

“The fact is, the committee is not thinking about rate cuts right now at all,” said Powell at the press conference in November.

So, what happened to “higher for longer?” What’s changed since then? From the Fed’s perspective, a lot.

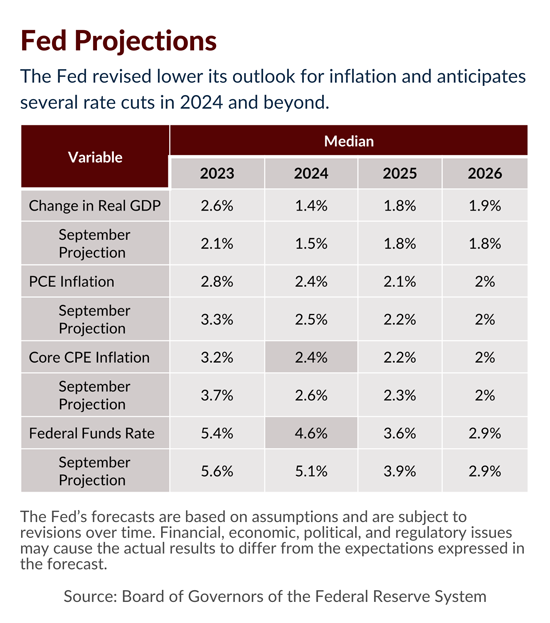

In the table below, take a look at some of the Fed’s 2024 projections and beyond. For Core Personal Consumption Expenditures, the Fed now sees it falling to 2.4% in 2024, down from 3.2% in 2023. The Fed also sees Fed Funds at 4.6% by the end of 2024. But that’s the median forecast. At least one Fed voting member sees 3.9%. So the Fed funds could be much lower than today’s rate of 5.25%-5.5%.

Judging from the Fed’s outlook, it appears that we are entering a transition period that will lead to lower rates. But nothing is certain until the Fed acts. If rates do start to trend lower next year, I will be evaluating portfolios to determine if any adjustments are needed for the new interest rate environment.

Enjoy the holiday season!

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.