Fed Presidents Signal an End to Rate Hikes

Fed Presidents Signal an End to Rate Hikes

You may have come across the notion that the Federal Reserve is attempting to “thread the needle” with the economy by raising interest rates in order to moderate growth without triggering a recession.

Now, we’re in crunch time of that plan where the thread is passing through the eye of the needle.

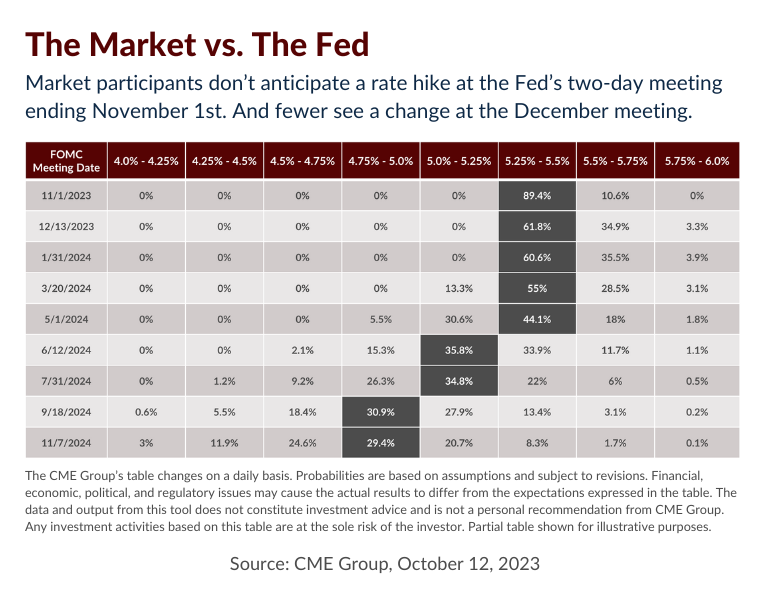

Fed Chair Jerome Powell has said one more rate hike may be necessary before the end of the year. But as you can see from the chart, market participants are calling his bluff and are not anticipating any more rate increases in 2023. (The Fed’s current target rate is 5.25% to 5.5%.)

In fact, other voting members of the Federal Open Market Committee (FOMC) — the governing body that decides on rate changes — seem to agree that rates are high enough. Atlanta Fed President Raphael Bostic recently commented that he doesn’t see the need for more rate hikes this year. A short time later, Philadelphia Fed President Patrick Harker said he thinks the central bank can stop raising rates.1,2

The October inflation report didn’t appear to clarify the rates-inflation-economy debate but instead added a bit of confusion to the delicate balance that the Fed is trying to maintain.

The September Consumer Price Index (CPI) came in slightly higher than anticipated, but the real story lies in the underlying data. For example, hotel prices showed a 51% annualized increase compared to a 43% annualized decline the month before. Therefore, headline CPI data should be taken with a grain of salt.3

The Fed has two meetings left this year. Let’s hope Chairman Powell and his colleagues can see through the confusion and reach a consensus on what’s next for rates.

1Reuters.com, October 10, 2023. “Fed’s Bostic sees no more U.S. rate hikes, no recession.”

2CNBC.com, October 13, 2023. “Philadelphia Fed President Harker advocates holding interest rates ‘where they are.’”

3FundStrat.com, October 12, 2023.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.