Making Sense of Recent Market Volatility

Making Sense of Recent Market Volatility

If you have noticed the financial markets experiencing a tumultuous last few weeks, you’re not alone. Market movements seem to be driven by one news event after another.

Investors were on edge leading up to Fed Chair Jerome Powell’s speech at the Jackson Hole symposium at the end of August. A few days earlier, markets eagerly anticipated the Q2 earnings report from Nvidia, a leading manufacturer of Artificial Intelligence (AI) components and technology. Even Charles Payne, CEO & Principal Analyst at WStreet.com, noted the seemingly unprecedented level of excitement surrounding the report, “I cannot remember the last time there was this much excitement for an earnings report.”

When overall trading is thin (like it typically is in August when many investors are on vacation), the market is more prone to heightened volatility. However, now that Labor Day is behind us and school is beginning, investors are returning to their desks and market activity will resume its normal cadence.

Does that mean that volatility will slow down as a result? Not necessarily. September and October will yield their fair share of concerns within the markets before inevitably shifting their attention to the year’s end.

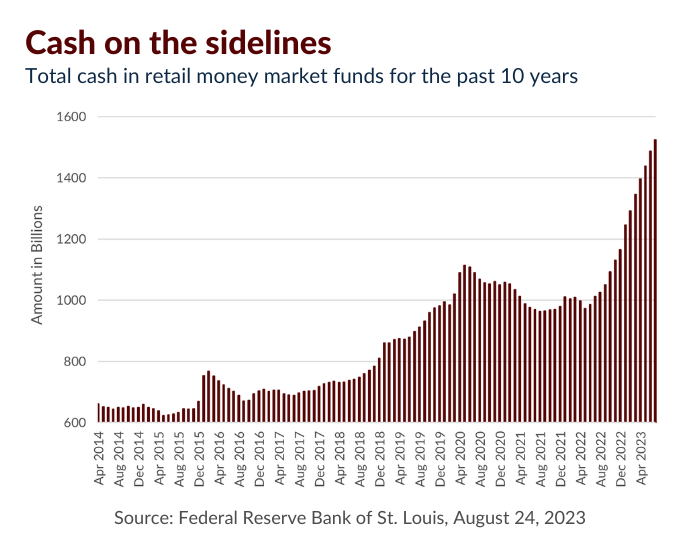

In this chart, you can see that total cash on the sidelines has climbed to almost $1.6 trillion. This signifies that 2022 seemed to instill fear in many investors and they still have not fully recovered. These funds are now invested in alternative securities due to such high interest rates, but I anticipate that this will begin to trend lower in the upcoming year. What will happen if that money starts looking for a new home?

Related Topics

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investment advisory services are offered through Concord Wealth Partners, an SEC Registered Investment Advisor.