Homeowners: Is Your Home an Asset or a Liability?

Homeowners: Is Your Home an Asset or a Liability?

You may have heard the saying, “It’s a buyer’s market,” but what does that really mean for homeowners? In the current residential real estate market, many homes are selling for under their asking price and taking longer to sell. While this shift is great news for buyers, it’s far less favorable for sellers.

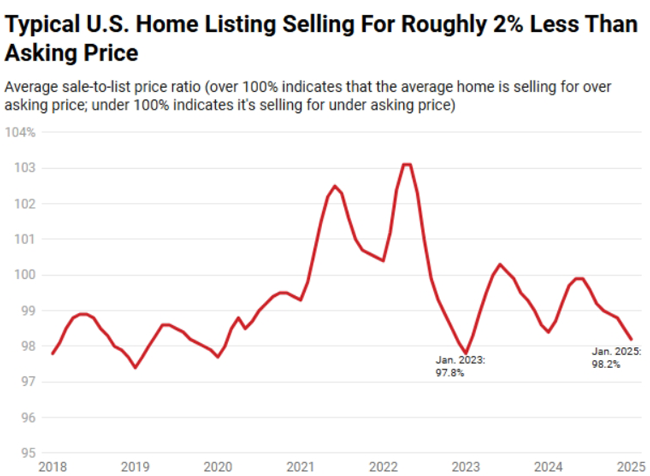

According to RedFin, homes are selling for nearly 2% below asking price and sitting on the market for an average of 56 days — the longest period in nearly five years. Unsurprisingly, rising mortgage rates are the primary driver behind this slowdown. With rates climbing, monthly payments have reached near-record highs, putting increased pressure on homeowners.

Source: RedFin.com, February 12, 2025

I’m not a real estate professional, but I do understand that a home is a critical asset for many individuals and families. As a financial advisor, my job is not to estimate the value of your home, but rather to determine its role in your overall financial strategy. Is it a reliable asset that strengthens your financial foundation, or could it turn into more of a liability over time?

Imagine a married couple with adult children who are looking to downsize to free up equity for retirement. They might envision their home selling quickly, but current market conditions and higher mortgage rates causes the listing to linger longer than expected. This could not only impact their retirement timeline but also require them to adjust their short-term financial strategy.1

Your home is likely one of the most significant investments you will make in your lifetime, so understanding its role in your financial strategy is key to staying ahead of shifting real estate trends. If you’re looking to evaluate how your home aligns with your long-term financial goals or how to adapt your strategy to changing market conditions, let’s talk.

1Hypothetical examples are for illustrative purposes only. These examples do not constitute as investment, legal, or tax advice for any person or persons having circumstances similar to those portrayed and a financial advisor should be consulted. These examples do not represent actual clients. Any resemblance to actual people or situations is purely coincidental.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.