'Smart Money' on Interest Rates

'Smart Money' on Interest Rates

Have you ever heard the expression, “What’s the smart money doing?”

“Smart money” is an expression that often refers to experts and suggests that well-informed people have a better perspective on current events and what actions to take. However, there’s little evidence to suggest that “smart money” performs any better.

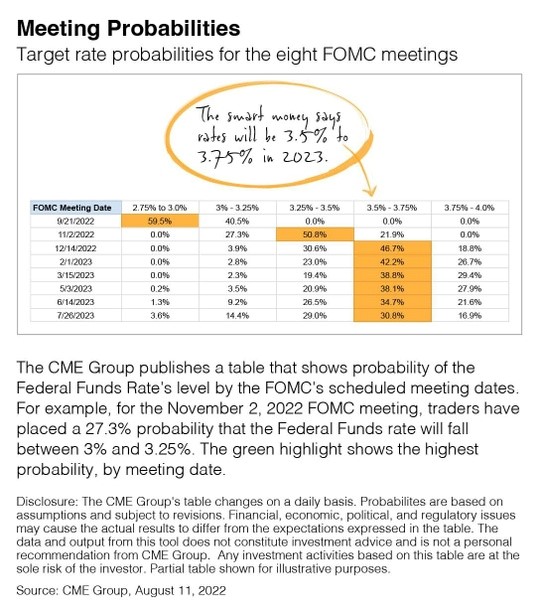

Still, some “experts” can be confident enough to take action based on their beliefs or opinions. The table below shows what the smart money zeitgeist thinks the Federal Reserve will do during its upcoming meetings on interest rates.

As a reminder, the current target Federal Funds rate is 2.25% to 2.5%. At this point, smart money appears to favor a 0.5% increase over a 0.75% bump at the September 21 meeting. But remember, these percentages can change as quickly as the fluctuating economy.

The Meeting Probabilities table is one of many data points I look at when considering what’s next for markets. But for you, the smartest move is to make sure you’re on track with the investment goals we’ve already outlined. If you ever have any questions about your investment plan, feel free to reach out.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.