Why the Fed Can't Figure Out the Jobs Market

Why the Fed Can't Figure Out the Jobs Market

As the Fed continues its fight against inflation, one of the more challenging parts of the economy is gauging what’s happening in the jobs market.

One July report showed the private sector added nearly 500,000 jobs, double the expectations. Meanwhile, another July report showed that job openings fell by 500,000, also above expectations.

In explaining why the Fed may boost interest rates again in 2023, Fed Chair Powell said, “What’s really driving it…is a very strong labor market.”1

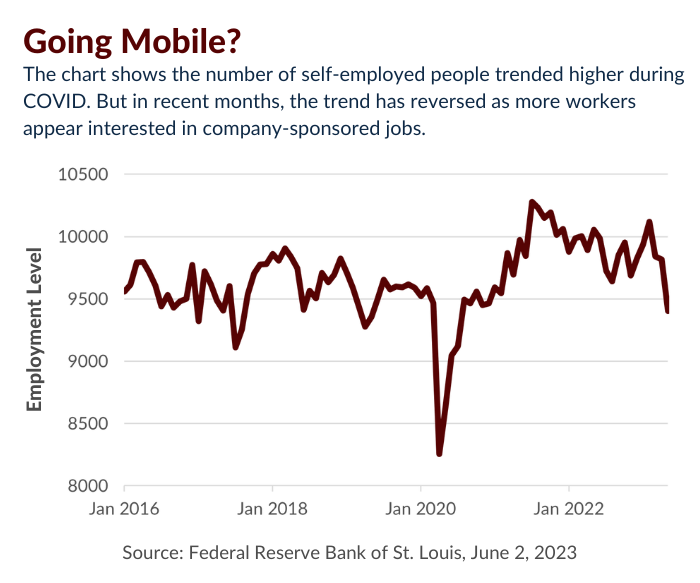

The accompanying chart shows why the Fed struggles to understand what’s happening with today’s jobs market.

As you can see, the number of self-employed people rose to an all-time high during COVID. But now it’s falling at a rapid pace. What’s causing the drop? More people appear to be returning to work at 9-5 jobs, perhaps fearful that the economy might collapse into a recession. When economic growth slows, perceptions may hold that 9-5 jobs seem more secure.

The Fed has several mandates, including managing the nation’s monetary policy to promote stable prices and maximum employment.

Sometimes, those two jobs can conflict. If you raise rates too high and economic growth slows in response, higher unemployment may be the outcome. Don’t raise rates enough, and inflation can raise prices. Add in the twist of how COVID influenced the jobs market, and you can see why the Fed may be scratching its head a bit with interest rates.

One of my favorite sayings is, “Don’t worry about the horse. Just load the wagon.” In this instance, perhaps a more accurate saying would be, “Don’t worry about the Fed. Just focus on the investment strategy we created.”

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.