A Taxing Story: Capital Gains and Losses

A Taxing Story: Capital Gains and Losses

Capital gains result when an individual sells an investment for an amount greater than their purchase price. Capital gains are categorized as short-term gains (a gain realized on an asset held one year or less) or as long-term gains (a gain realized on an asset held longer than one year).

Long-Term vs. Short-Term Gains

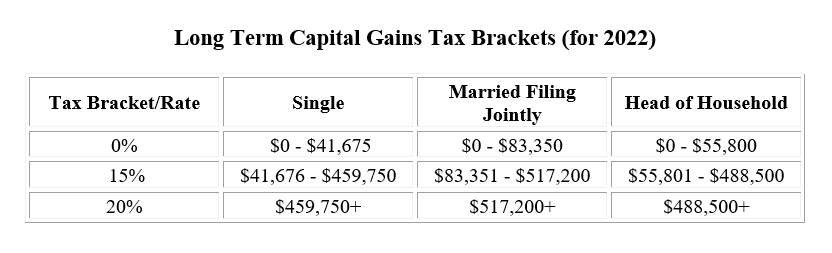

Short-term capital gains are taxed at ordinary income tax rates. Long-term capital gains are taxed according to different ranges (shown below).1

It should also be noted that taxpayers whose adjusted gross income is in excess of $200,000 (single filers or heads of household) or $250,000 (joint filers) may be subject to an additional 3.8% tax as a net investment income tax.1

Also, keep in mind that the long-term capital gains rate for collectibles and precious metals remains at a maximum of 28%.2

Rules for Capital Losses

Capital losses may be used to offset capital gains. If the losses exceed the gains, up to $3,000 of those losses may be used to offset the taxes on other kinds of income. Should you have more than $3,000 in such capital losses, you may be able to carry the losses forward. You can continue to carry forward these losses until such time that future realized gains exhaust them. Under current law, the ability to carry these losses forward is lost only on death.3

Finally, for some assets, the calculation of a capital gain or loss may not be as simple and straightforward as it sounds. As with any matter dealing with taxes, individuals are encouraged to seek the counsel of a tax professional before making any tax-related decisions.

1Investopedia.com, July 19, 2022

2Investopedia.com, May 4, 2022

3Investopedia.com, March 22, 2022

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.