June CPI, The Fed & Interest Rates

June CPI, The Fed & Interest Rates

Jerome Powell skipped an interest rate hike at the Fed’s June meeting, but the market isn’t buying what the Fed Chair is selling about what’s next with short-term rates.

Powell signaled that two more rate increases may still be in store for later this year and indicated that “we’re talking about a couple of years out” before the Fed might cut rates.1

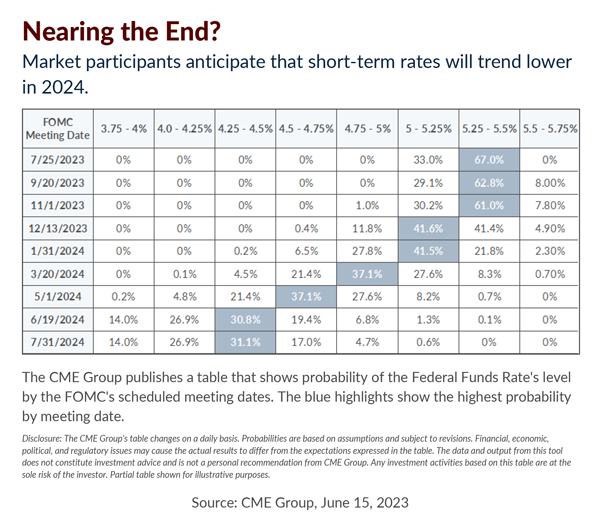

But that’s not what market participants anticipate. As you can see in the accompanying chart, most see one more rate increase later this year, and the consensus sees rates trending lower as early as December 2023.2

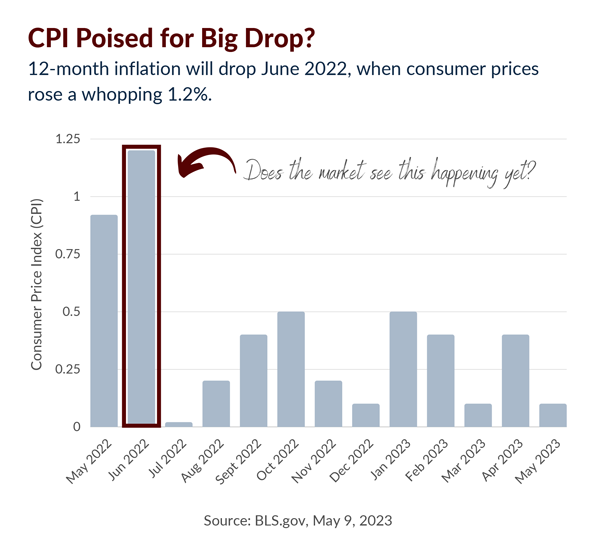

To Powell’s credit, he said the Fed hasn’t yet decided on July’s policy, which means all eyes will closely watch economic reports such as the Consumer Price Index (CPI). As you can see in the next chart, this month the whopping 1.2% increase from June 2022 will be dropped from the 12-month rate.3

The Cleveland Fed, which published the widely followed Inflation Nowcasting tool, is forecasting a 3.22% annual rate for CPI in June 2023. That’s getting close to the Fed’s long-term inflation target of 2.0%.

But I can understand why Fed Chair Powell is conservative with his interest rate outlook. He was the same person who tried to convince the markets that “inflation was transitory” in early 2021. He doesn’t want his legacy as Fed Chair to be that he underestimated inflation — twice!

Navigating monetary policy in recent years has been extremely challenging. But I expect the Fed will be happy to report upbeat news in the months ahead if warranted.

1CNBC.com, June 14, 2023. “Fed Recap; Breaking down the market’s reaction to the Fed’s pause and all of Powell’s key comments.”

2Forecasts are based on assumptions and are subject to revisions over time. Financial, economic, political, and regulatory issues may cause the actual results to differ from the expectations expressed in the forecast.

3BLS.gov, June 13, 2023

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.