Q3 GDP: What's Next After Inflation?

Q3 GDP: What's Next After Inflation?

Wall Street is gradually turning its attention towards an “expansion economy” and leaving behind any concerns of a recession. With the recent release of a soft consumer inflation report in July, the focus will soon shift to the gross domestic product in the upcoming weeks, along with resolutions to various pending matters.

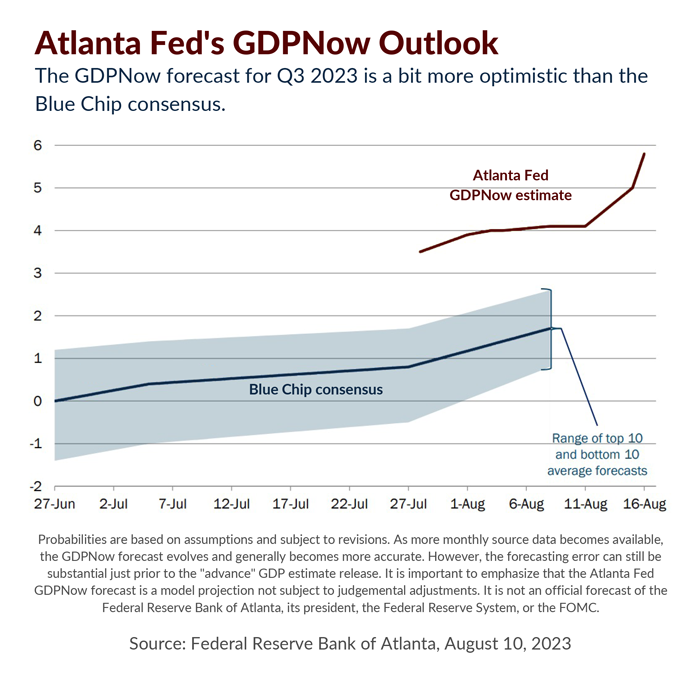

As seen in the chart below, the Atlanta Fed’s GDPNow forecasting tool is projecting a robust 4.1% growth for Q3. However, economists’ Blue Chip consensus suggests a more modest growth of less than 1% for the same period.

Why is there such a significant disparity between these numbers? Economists seem to be slow in updating their forecasts, presumably due to the stark contrast between the current economic trends and their initial expectations for 2023. Be sure to mark October 26 down on your calendar – that’s when the advanced estimate for Q3 GDP will be released.

Remember, GDP is measured by adding up consumption (C), government spending (G), investment (I), and net exports (NX). If GDP does in fact increase by 4.1%, it means one or all of these components are driving overall economic growth.

Over time, the Atlanta Fed GDPNow estimate and the projections of Blue Chip economists are expected to align. But then the question is, how will the financial markets respond?

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.