When the Fed Chair Talks, People Listen

When the Fed Chair Talks, People Listen

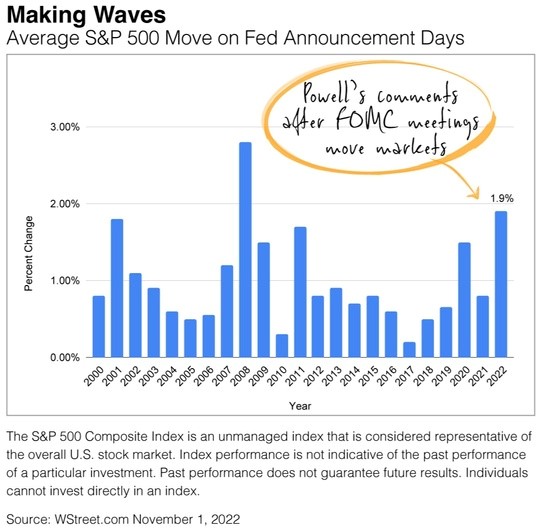

The financial markets are on edge this year each time Fed Chair Jerome Powell takes the podium following a Federal Open Market Committee (FOMC) meeting.

The chart below shows that the Standard & Poor’s 500 stock index has gained or lost an average of 1.9% following the first six two-day FOMC meetings in 2022. And after the most recent November 2nd meeting, stocks see-sawed throughout the session but eventually ended the day sharply lower after hearing from the Fed Chair.

Initially, investors cheered when the official FOMC statement suggested that the Fed would consider all data before adjusting rates again. But Powell crushed the enthusiasm in his post-meeting press conference, saying the current inflation data did not support any change in the Fed’s position.

In many ways, Powell’s tough talk is understandable. Throughout 2021, he told investors that inflation was “transitory” and the FOMC made no change to monetary policy. But in 2022, inflation has been stubbornly high, and it’s the Fed’s job to maintain price stability. So, in some ways, Powell wants to restore the Fed’s credibility.

As you may have heard me say, “Don’t worry about the horse; just load the wagon.” Now is a time to stay focused on “your wagon,” and we’ll keep an eye on the “horses” at the FOMC.

Related Topics

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investment advisory services are offered through Concord Wealth Partners, an SEC Registered Investment Advisor.