The Impact of the Pandemic on Money Supply

The Impact of the Pandemic on Money Supply

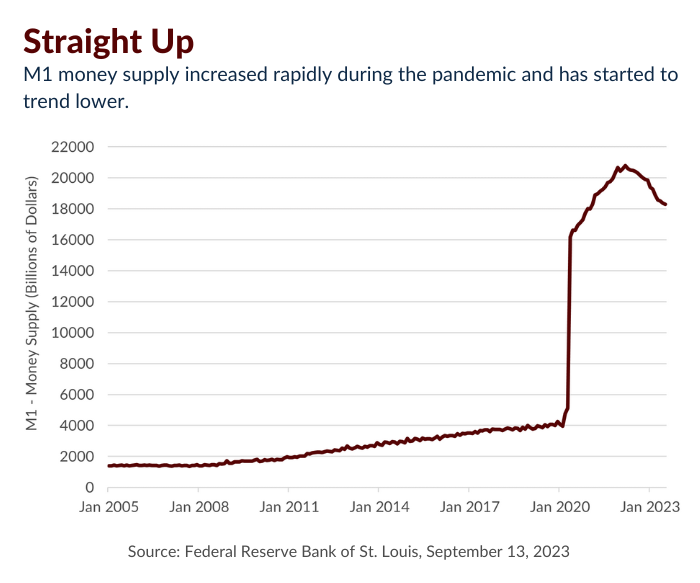

The saying goes that a picture can tell a thousand words, and this chart depicting the M1 money supply does just that.

During the pandemic, M1 rose rapidly as a result of federal stimulus packages that were implemented to support individuals who faced financial hardships. M1 represents the total amount of currency and bank deposits held by the public. M2, on the other hand, includes M1 money supply as well as other easily convertible assets into cash.

When analyzing a chart such as this one, it becomes apparent why inflation has been on the rise in recent years. Economist Milton Friedman famously stated, “Inflation is caused by too much money chasing after too few goods.” This encapsulates what has been unfolding in the economy since the onset of the pandemic. An influx of cash from relief measures, combined with a decrease in production and supply of goods, has helped foster an inflationary scenario.

However, over the past few months, M1 has started to trend lower. In fact, it is declining at a rate not seen since 1930. So, what exactly is going on?1

M1 appears to be shifting for a variety of reasons, with the predominant one being the expenditure of stimulus funds. This trend is expected to continue for the foreseeable future.

When I observe charts like this one, I can’t help but feel relieved that I’m not a Federal Reserve governor. Determining monetary policy is an enormous challenge that requires officials to consider many different factors. As wealth advisors, we may not always agree with the Fed’s approach, but we understand the elements involved in their decisions and are constantly evaluating the possible outcomes.

If you have questions or concerns about the state of the economy, reach out to your advisor to discuss the most effective ways to navigate times of uncertainty.

1Reuters.com, March 30, 2023. “US money supply falling at the fastest rate since 1930s.”

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.