Why the Fed is Focused on Your Paycheck

Why the Fed is Focused on Your Paycheck

The Federal Reserve has a dual mandate: to control inflation and to optimize employment. This is fundamental to our national economic health, but these objectives can sometimes appear to conflict with one another.

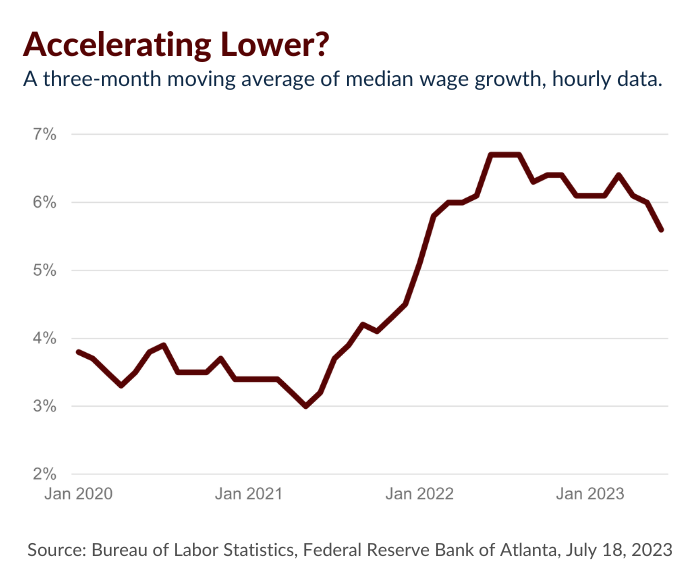

In 2022, labor shortages began to put pressure on businesses to raise wages. These wage increases led to a surge in disposable income and ultimately an increase in consumer spending, which can be a catalyst for inflation.

But 2023 is telling a different story. Median wage growth is heading lower while inflation is dropping, which is precisely what Fed Chair Jerome Powell wants to see as he evaluates what’s next for short-term interest rates.

“I would say it’s certainly possible that we will raise funds again at the September meeting if the data warranted,” said Powell after the Fed’s July meeting. “And I would also say it’s possible that we would choose to hold steady, and we’re going to be making careful assessments, as I said, meeting by meeting.”1

With wages lower and consumer prices trending down, we’re closer to the end of the rate-hike cycle than in the beginning. The next Fed meeting is in September, but Federal Reserve officials will be making several speeches during the next few weeks, so I will continue to keep you updated on the latest.

1CNBC.com, July 26, 2023. “Fed approves hike that takes interest rates to highest level in more than 22 years.”

Related Topics

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investment advisory services are offered through Concord Wealth Partners, an SEC Registered Investment Advisor.