What's Next for Interest Rates?

What's Next for Interest Rates?

What does the bond market know that the Fed isn’t telling us?

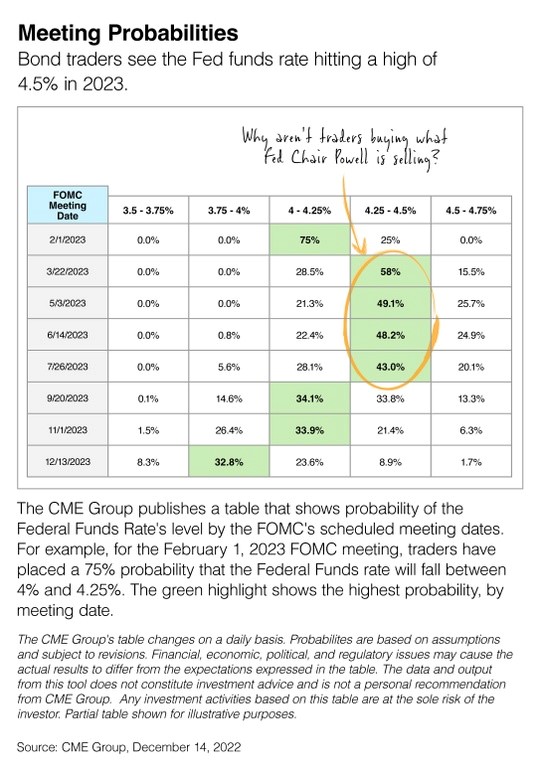

Fed officials recently have said that short-term rates will need to climb to over 5 percent to bring inflation under control. But in the table below, you can see that the bond traders say short-term rates will top out at 4.5 percent in 2023 and then head lower.

The bond market is more dovish than the Fed. And perhaps with good reason. The November Consumer Price Index report came in below expectations, and there are more and more signs that inflation has started to trend lower, which may suggest the Fed’s work is coming to an end.

So why is the Fed talking so tough? As many of you may recall, Fed Chair Jerome Powell said inflation was “transitory” throughout much of 2021. The Fed Chair doesn’t want to mischaracterize inflation again.

I work with other financial professionals who listen to comments from Fed officials and compare them to what the bond market is saying. So, if you happen to hear commentary about the Fed that’s unsettling in any way, please let me know and we can review what’s going on.

Related Topics

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Concord Wealth Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Wealth Partners is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Concord Wealth Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or on our website. Please Note: If you are a Concord Wealth Partners client, please remember to contact Concord Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.